Project: PiggyBank Finances - Financial Tracking

Category: All

PiggyBank - Advanced Personal & Household Financial Management Platform

Overview

PiggyBank is a sophisticated, subscription-based financial management platform that transforms how individuals and families track, plan, and optimize their financial health. Built with modern web technologies and enterprise-grade infrastructure, the platform provides comprehensive financial oversight through intelligent budgeting, debt management, and savings optimization.

Core Features

🏠 Multi-Household Financial Management

Shared Financial Oversight

: Create and manage multiple households with role-based access (owner, admin, member)

Collaborative Budgeting

: Share expenses, budgets, and financial goals with household members

Unified Financial Picture

: Consolidate all household financial data in one comprehensive dashboard

Smart Resource Association

: Automatically link existing financial data when creating new households

💰 Intelligent Budget Planning & Tracking

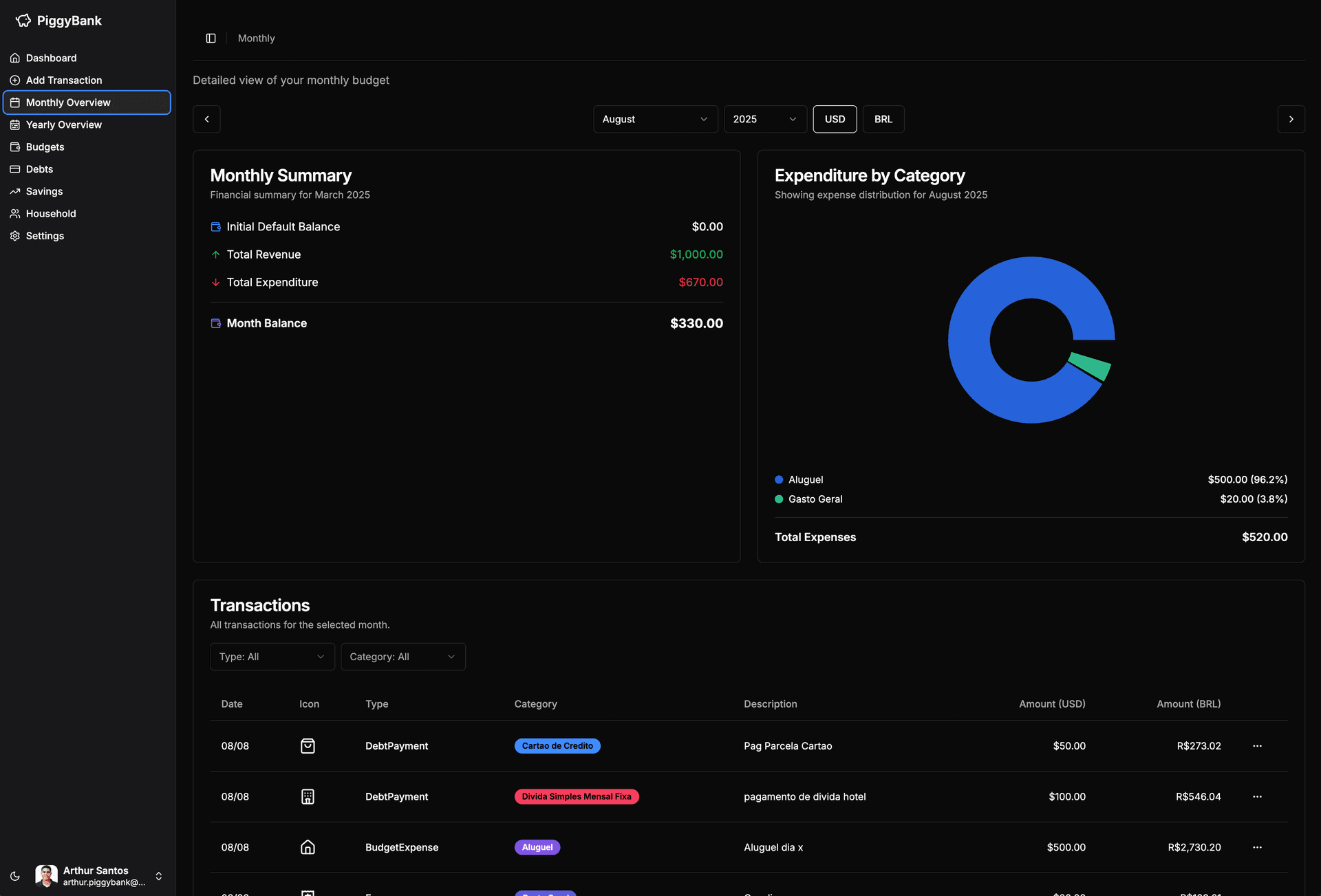

Zero-Based Monthly Budgeting

: Start each month fresh with comprehensive budget planning

Real-Time Budget Reconciliation

: Compare planned vs. actual expenses with automatic calculations

Category-Based Budgeting

: Organize spending by custom categories with visual icons

Budget Performance Analytics

: Track budget adherence with detailed monthly reports

🎯 Advanced Debt Management System

Comprehensive Debt Tracking

: Monitor total debt, remaining balances, and payment schedules

Flexible Payment Scheduling

: Create custom payment plans with due dates and amounts

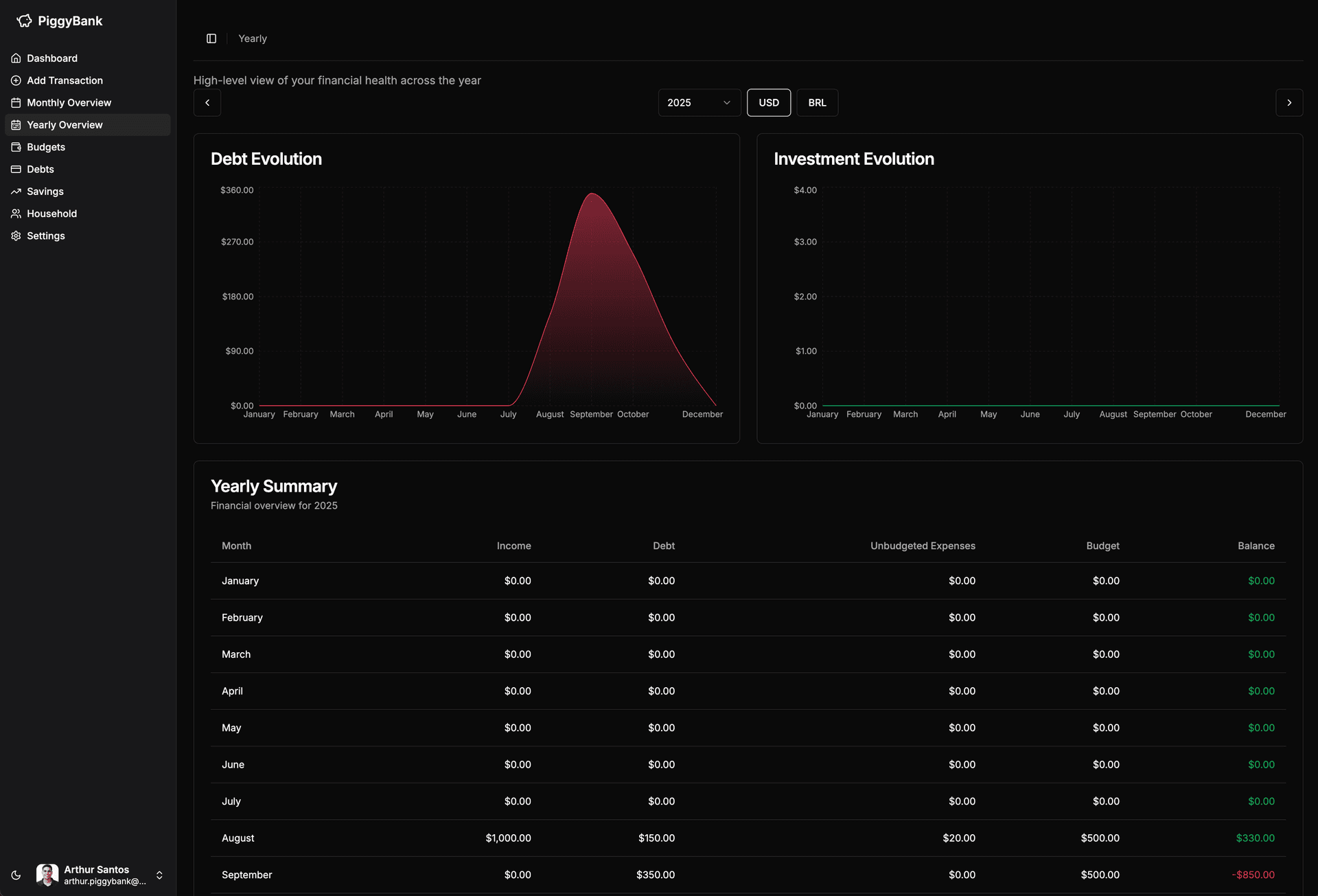

Debt Evolution Analytics

: Yearly debt reduction tracking and progress visualization

Payment Reconciliation

: Link debt payments to actual transactions for accurate tracking

🚀 Smart Savings & Investment Tracking

Goal-Oriented Savings Buckets

: Create targeted savings goals for specific financial objectives

Investment Progress Monitoring

: Track investment contributions and growth over time

Savings Category Management

: Organize savings by purpose with custom categories

Financial Goal Visualization

: Monitor progress toward savings targets

📊 Multi-Dimensional Financial Analytics

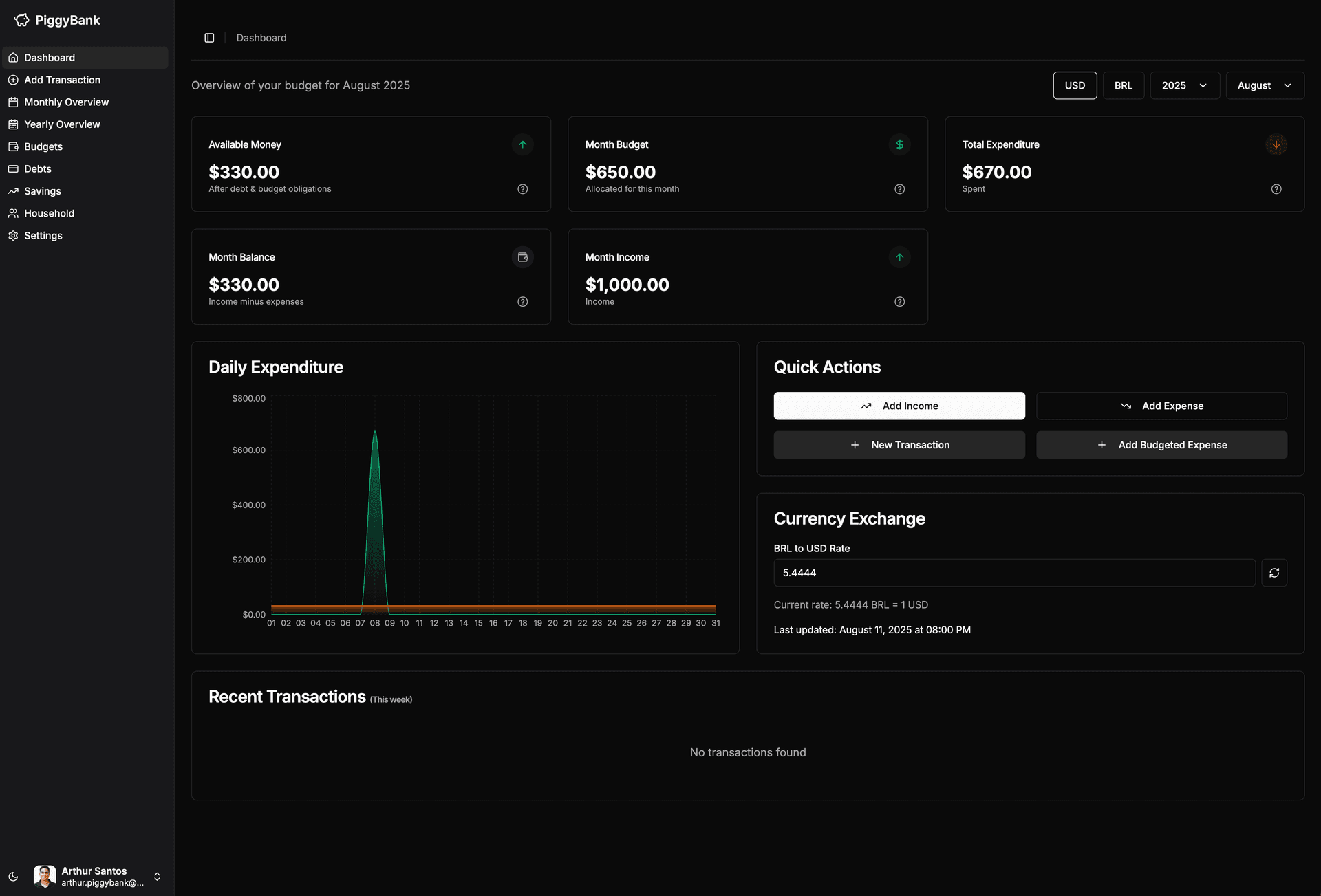

Real-Time Dashboard

: Current balance, available money, and monthly budget overview

Daily Expenditure Tracking

: Monitor spending patterns with daily breakdowns

Category Distribution Analysis

: Visual spending breakdowns with percentage allocations

Yearly Financial Evolution

: Track income, expenses, and savings trends over time

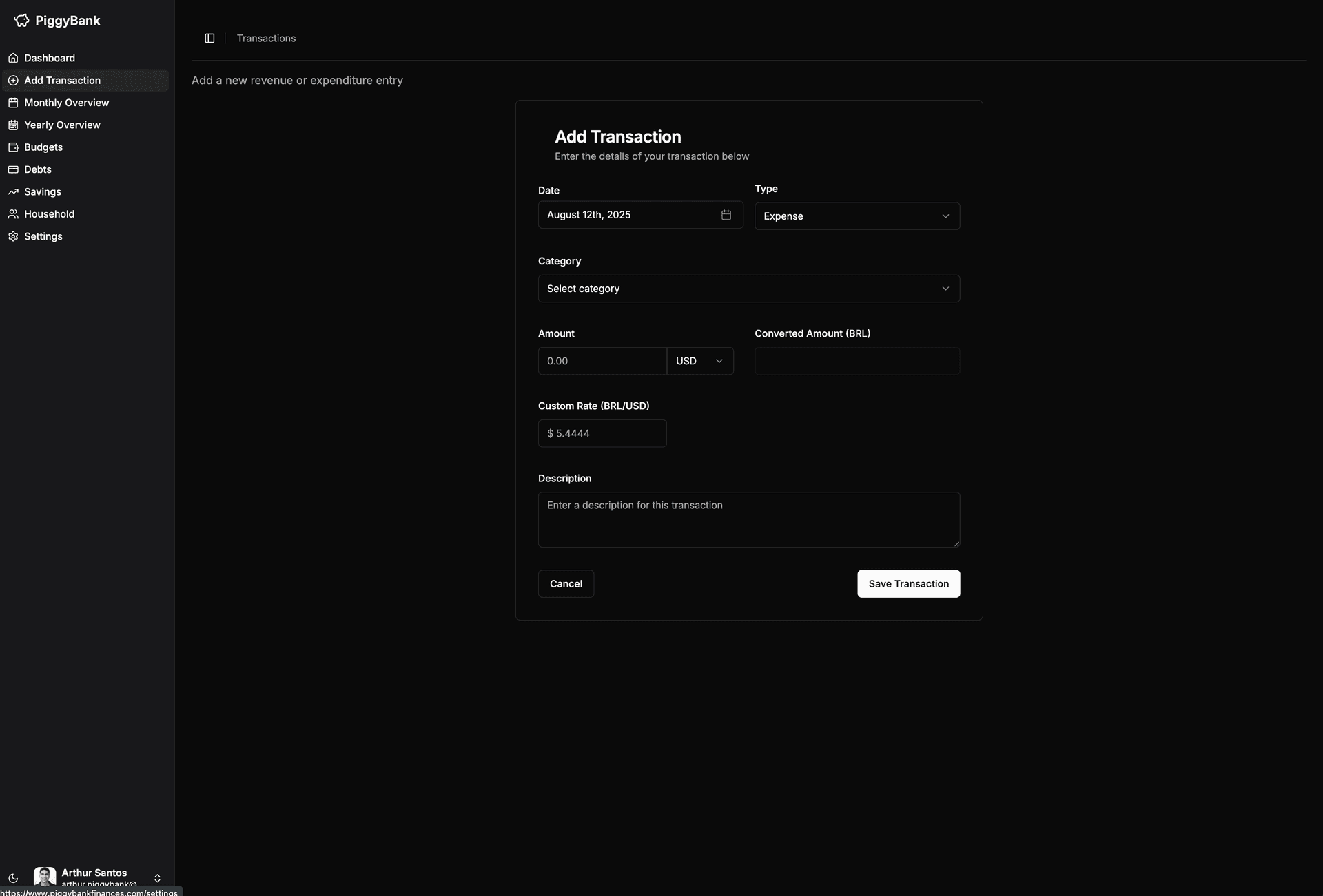

Currency Support

: Multi-currency support (USD/BRL) with automatic conversions

🔄 Transaction Management & Reconciliation

Comprehensive Transaction Types

: Income, expenses, debt payments, savings, and budget expenses

Smart Categorization

: Automatic category assignment with manual override options

Transaction Splitting

: Split shared expenses among household members

Historical Analysis

: Complete transaction history with search and filtering capabilities

Technical Architecture

Modern Tech Stack

Frontend

: Next.js 14 with React 18 and TypeScript

Backend

: tRPC for type-safe API communication

Database

: PostgreSQL with Drizzle ORM for optimal performance

Authentication

: Better Auth with Google OAuth integration

Storage

: Cloudflare R2 for scalable file storage

Caching

: Redis-based KV storage for high-performance data access

Enterprise-Grade Infrastructure

Performance Optimized

: 45+ database indexes for sub-100ms query response times

Scalable Architecture

: Serverless-ready with connection pooling and caching

Security First

: Row-level security, authenticated API endpoints, and secure file handling

Real-Time Updates

: Optimistic UI updates with automatic cache invalidation

Subscription & Payment Integration

Stripe Integration

: Seamless subscription management with webhook handling

Pro Plan ($29.99/month)

: Unlimited transactions, categories, and households

Family Plan ($60/month)

: Up to 4 household members with shared access

Admin Free Access

: Comprehensive admin controls for user management

Business Value Proposition

For Individual Users

Financial Clarity

: Transform complex financial data into actionable insights

Goal Achievement

: Structured approach to debt reduction and savings growth

Budget Discipline

: Zero-based budgeting methodology for better financial control

Progress Tracking

: Visual progress indicators for all financial objectives

For Households & Families

Shared Financial Goals

: Align family spending with collective financial objectives

Transparent Spending

: Full visibility into household financial health

Collaborative Planning

: Joint budget creation and expense management

Accountability

: Role-based access ensures proper financial oversight

For Financial Advisors & Accountants

Client Portfolio Management

: Comprehensive financial overview for multiple clients

Progress Reporting

: Detailed analytics for client financial health assessment

Goal Tracking

: Monitor client progress toward financial objectives

Data Export

: Professional reporting capabilities for client meetings

Market Differentiation

Advanced Analytics

Unlike basic budgeting apps, PiggyBank provides sophisticated financial modeling with real-time reconciliation between planned and actual expenses, offering users unprecedented insight into their financial behavior.

Household Financial Management

The platform's unique multi-household architecture enables families and roommates to manage shared finances while maintaining individual privacy and accountability.

Professional-Grade Infrastructure

Built with enterprise-level technologies, the platform delivers sub-100ms response times and 99.9% uptime, ensuring a professional user experience that scales with growing financial complexity.

Comprehensive Financial Picture

From daily spending to yearly investment growth, PiggyBank provides a complete financial ecosystem that grows with users' financial sophistication and needs.

Target Audience

Young Professionals

: Building financial foundations and managing student debt

Families

: Coordinating household finances and planning for major expenses

Small Business Owners

: Managing personal and business financial separation

Financial Enthusiasts

: Seeking detailed analytics and financial optimization

Financial Advisors

: Managing client portfolios and progress tracking

PiggyBank represents the next generation of personal finance management, combining sophisticated financial analytics with intuitive user experience to empower users toward better financial health and goal achievement.